Cashflow quadrants free#

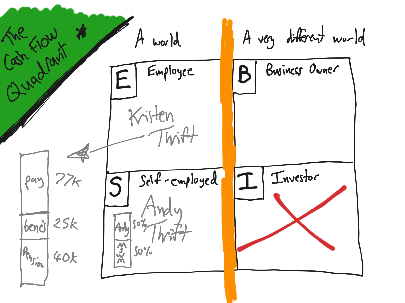

For me, I just want to be financially free to live a simple life. It might suit ambitious, ruthless, executive types whose only ambition in life is to earn a lot of money for money's sake without a care as to who or what it hurts, or the environmental consequences. Most of the assumptions about income, tax, benefits, political situation. I'm going to stop now, it's wasting my time - I've work to do! Part of the problem I have with the book is that it's primarily geared towards Americans. At its simplest, the Cashflow Quadrant is a way to categorize people based on where their money comes from: E, S, B, or I. The author thinks that to be self-employed is worthless and somewhat pathetic, unless you have a business employing at least 500 people. Kuadran E (Employee) Kuadran pertama yaitu employee (karyawan), yang memilih mencari keamanan dan kenyamanan dalam memperoleh penghasilannya dengan cara bekerja sehingga mendapatkan gaji setiap bulan. It might or might not be possible to reach such 'heights'. Berikut adalah penjelasan tentang 4 kuadran yang ada dalam cashflow quadrant. I have never aspired to that level of wheeler-dealing, and I would rather die than be that kind of person. As co-oauthor of RICH DAD, POOR DAD and THE CASHFLOW QUADRANT, she now focuses her efforts in helping to create educational tools for anyone interested in bettering their own financial education. Kiyosaki’s cashflow quadrant is meant to teach you the fundamentals of how money works and how the rich leverage different quadrants to grow wealth. Lechter is a wife and mother of three, CPA, consultant to the toy and publishing industries and business owner. This can be represented in a visual of four different quadrants (above). But after listening to this book I realise I honestly, truly do not want to be 'rich', in the sense the author means. The premise of the Cashflow Quadrant is that there are four main ways of earning income. Yes, I would like to be more financially secure. The financially astute, however, maximize the amount of time spent on activities in these quadrants. The world described in this book - a world the author believes everyone should aspire to - is not a world I wish to live in. The only problem is that to build assets which may decline in value (houses, possessions), they take on greater amounts of debt, locking them in to working harder still to earn more to service more debt.

0 kommentar(er)

0 kommentar(er)